【Breaking News】(IPO)Zhixin Group Holding (2187.HK) Announces Proposed Listing on the Main Board of The Stock Exchange on 26 March 2021

【Breaking News】(IPO)Zhixin Group Holding (2187.HK) Announces Proposed Listing on the Main Board of The Stock Exchange on 26 March 2021

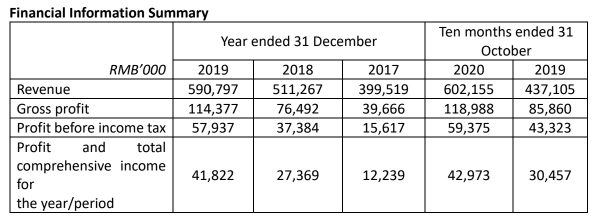

Zhixin Group Holding Limited (“the Company”, together with its subsidiaries collectively known as “the Group”) (Stock Code: 2187.HK), a manufacturer and supplier of concrete-based building material in Xiamen, Fujian Province of the PRC, today announces its plan to list on the Main Board of The Stock Exchange of Hong Kong Limited (the“Stock Exchange”) on 26 March 2021. The Group’s principal products can be broadly categorized as (i) ready-mixed concrete; and (ii) precast concrete components (‘‘PC components’’).

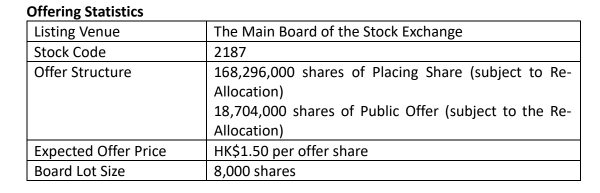

The Group plans to offer an aggregate of 187,000,000 shares, of which 18,704,000 shares (subject to re-allocation as described in the section headed ‘‘Structure of the Share Offer’’ and“Our Cornerstone Investors” in the Company’s prospectus dated 16 March 2021 (“the ReAllocation”)) are public offer shares and 168,296,000 shares (subject to the Re-Allocation) are placing shares, expected at an offer price of HK$1.50 per offer share. The public offer will open at 9:00 a.m. on Tuesday, 16 March 2021 and will close at 12:00 noon on Friday, 19 March 2021.Dealings in the shares on the Main Board of the Stock Exchange are expected to commence at9:00 a.m. on Friday, 26 March 2021. The shares will be traded in board lots of 8,000 shares each. The stock code of the shares is 2187.

Sole sponsor of the listing is Kingsway Capital Limited. Joint bookrunners are Kingsway Financial Services Group Limited, Seazen Resources Securities Limited, Zhongtai InternationalSecurities Limited, Haitong International Securities Company Limited and SPDB International Capital Limited. Joint lead managers are Kingsway Financial Services Group Limited, Seazen Resources Securities Limited, Zhongtai International Securities Limited, Haitong International Securities Company Limited, SPDB International Capital Limited and ZMF Asset Management Limited.

Mr. Ye Zhijie (葉志杰) (“Mr. Ye”), executive director, chairman of the board and the founder of the Group, said, “The listing on the Stock Exchange marks an important milestone for our Group. It can enhance our competitiveness in the market and attract more potential customers. With sufficient funding and an enhanced company profile as a Main Board listed company, we wish to strengthen our market position and thrive our market share in the construction industry in Fujian Province.”

The directors believe that the Group has the following competitive strengths:

The Group is a leading manufacturer in Xiamen offering high quality ready-mixed concrete with solid track record

The Group is largest ready-mixed concrete manufacturer and supplier in Xiamen in terms of production volume in 2019, with market share of approximately 7.2%, according to Frost & Sullivan Report. The Group has supplied ready-mixed concrete in Xiamen for more than 13 years since 2007. The high quality of its ready-mixed concrete products is demonstrated by the Group’s success of being repeatedly granted Excellent Enterprises in the China Concrete Industry* (中國混凝土行業優秀企業) between 2008 and 2019, certifying that its production facilities and product quality have complied with the ready-mixed concrete national standard in the PRC. With over 13 years of experience in producing and supplying ready-mixed concrete and working with construction companies for various types of building and construction projects including (i) infrastructure, (ii) residential, (iii) commercial and industrial, and (iv) municipal, the Group has established sound reputation in the construction industry in Xiamen. The directors believe that the quality of its products is essential to maintain the reputation of the Group.

The Group, as an pioneer in the precast concrete component (“PC component”) industry in Xiamen, is well prepared and positioned to capture new opportunities in the fast-growing prefabricated construction industry

The Group has invested in PC components production since 2014, which was put into commercial operation gradually in the second half of 2017. According to the Frost & Sullivan Report, the Group is a pioneer of the PC component industry in Xiamen. In 2019, the Group was the largest PC components provider in Fujian Province and Xiamen in terms of production volume, with market share of approximately 15.4% and 88.8% respectively. Due to the supportive PRC government policies towards green building, as well as citizens’ increasing demand for high quality residence driven by the general trend of consumption upgrade, the traditional construction methods are no longer sustainable. There are huge growth potentials in the prefabricated construction industry in the PRC, the total production volume of PC components in Xiamen increased from approximately 4,500 m3 in 2015 to approximately 95,000 m3 in 2019 at a CAGR of approximately 114.4%, according to the Frost & Sullivan Report. As such, the Group believes that prefabricated construction will become an inevitable trend of the construction industry as there are multiple advantages that prefabricated construction has over traditional construction in terms of efficiency, cost, environment protection and quality.

The Group has independent proprietary intellectual properties for PC production methods and equipment in relation to the production of the tunnel segments and utility tunnel segments, which are designed to be used in underground rail transit and integrated underground utility tunnels respectively. For the accelerating progress of urbanisation in Xiamen, Amoy Transit Rail is one of the key development projects in Xiamen. The Chinese Government regards the integrated underground utility tunnels as an important carrier for escalating the urban transformation, it has presented the new growth potentials.

The Group adopts a comprehensive and stringent quality control system

The Group endeavours to deliver quality and carefully produced ready-mixed concrete and PC component products to its customers. The Group imposed rigorous quality control measures and adopts a comprehensive set of stringent quality control procedures throughout its production cycle, including product design, raw material examination, production process and product delivery to ensure the product quality. The Group’s management system was certified in accordance with the standard required under ISO9001:2015 (quality management), OHSAS18001:2007 (occupational health and safety management) and ISO14001:2015 (environmental management).

The Group’s stringent quality control measures, backed by its standardised operational procedures, have enabled the Group to ensure consistently high quality and efficiency of its products and reduce the operational risks inherent in its operation. The Group’s ability to deliver its products with industry standards has enhanced the brand recognition among its customers and has further solidified its market leadership in Xiamen. The directors believe that the quality of its products is essential to maintain the reputation of the Group, which is the key factor for the Group to remain competitive and differentiate from its competitors, and hence the Group is devoted and committed to maintain the quality of its products and its high standard on quality management at both PRC national and industry standards could increase the customers’ confidence in its products and further attract new customers, especially SOEs in the PRC which have tight quality requirements on the ready-mixed concrete and PC components products.

The Group has an experienced management team with in-depth industry knowledge and

skilled employees

Mr. Ye, the founder, chairman of the Board and executive director, has over 13 years of experience in ready-mixed concrete industry. His in-depth industry knowledge and extensive management experience have ensured quality production and timely delivery of its products, which smooth the project’s progression and enhance the customers’ confidence. His experience and leadership will continue to play a key role in the future growth of the Group.

Mr. Huang, the Group’s chief executive officer and executive Director, has over 15 years of experience in the construction and construction material industry. Mr. Huang is mainly responsible for the Group’s strategic planning and supervision of implementation of the Group’s policies. He brings a strong base of knowledge to its day-to-day operations. The Group’s executive Directors and senior management possess relevant operational expertise and experience and are familiar with ready-mixed concrete and PC components manufacturing industry. They have enabled the Group to successfully achieve a competitive position in the industry.

In addition, the Group’s management team is supported by a team of skilled employees across all levels. The Group recognises the important roles that its employees contribute to the success of its business and place great emphasis in recruitment and training of its employees.

The Group believes that the management team’s technical expertise and professional knowledge of ready-mixed concrete and PC component industry and together with its well-trained employees are important to its business and will continue to strengthen and increase

its competitiveness in the industry.

The Group estimates that the net proceeds from the share offer (after deduction of underwriting fees and estimated expenses payable by us in relation to the share Offer, and assuming an Offer Price of HK$1.50 per offer share) are approximately HK$241.4 million (equivalent to RMB219.4 million). The directors intend to apply the net proceeds from the share offer for the following purposes:

• approximately HK$199.6 million (equivalent to RMB181.5 million), representing approximately 82.7% of the net proceeds of the share offer, will be used to expand its PC component production capacity at its PC Plant, of which (i) approximately HK$115.7

million (equivalent to RMB105.2 million), representing approximately 47.9% of the net proceeds of the share offer will be used to set up the PC component facility including a factory building, ancillary facilities and production lines; (ii) approximately HK$4.7 million (equivalent to RMB4.3 million), representing approximately 2.0% of the net proceeds of the share offer will be used to lease storage site(s) to support its enlarged production capacity; (iii) approximately HK$45.4 million (equivalent to RMB41.3 million), representing approximately 18.8% of the net proceeds of the share offer will be used to purchase raw materials for the production of PC components at its new

production lines; (iv) approximately HK$19.8 million (equivalent to RMB18.0 million), representing approximately 8.2% of the net proceeds of the share offer will be used to acquire flatbed trucks; and (v) approximately HK$14.0 million (equivalent to RMB12.7 million), representing approximately 5.8% of the net proceeds of the share offer will be used to enhance and expand its workforce to support its business expansion;

• approximately HK$8.8 million (equivalent to RMB8.0 million), representing approximately 3.6% of the net proceeds of the share offer, will be used to enhance its information technology system by introducing an ERP system so that its business operations can be better maintained and monitored;

• approximately HK$7.7 million (equivalent to RMB7.0 million), representing approximately 3.2% of the net proceeds of the share offer, will be used to further improve its environmental protection system in response to the expected increase in waste discharge and pollutants emission arising from its expansion plans;

• approximately HK$8.5 million (equivalent to RMB7.7 million) will be used to acquire five mixer and two concrete pump trucks, of which approximately HK$1.1 million (equivalent to RMB1.0 million) will be funded by the net proceeds of the share offer (representing approximately 0.5% of the net proceed of the share offer) and the balance of approximately HK$7.4 million (equivalent to RMB6.7 million) will be funded by internal resources; and

• approximately HK$24.2 million (equivalent to RMB21.9 million), representing approximately 10.0% of the net proceeds of the share offer, will be used as its general working capital.

About Zhixin Group Holding Limited (Stock Code: 2187.HK)

The Group is a leading manufacturer and supplier of concrete-based building material in Xiamen, Fujian Province of the PRC. Its principal products can be broadly categorized as (i) ready-mixed concrete; and (ii) precast concrete components (‘‘PC components’’). Its Group currently owns and operates two production plants, namely the RMC Plant and PC Plant and leases one production workshop, namely the Jimei Workshop, in Xiamen, with a current aggregate annual production capacity of approximately 1,439,000 m3 of ready-mixed concrete and approximately 119,800 m3 of PC components. With over 13 years of experience working with construction companies for various types of building and construction projects including (i) infrastructure, (ii) residential, (iii) commercial and industrial and (iv) municipal, the Group has established sound reputation in the construction industry in Fujian Province.

#breakingnews #finance #ZhixinGroupHoldingLimited #2187.HK #ProposedListing #MainBoard #TheStockExchange #26March2021

圖片來源:網絡

「TG」炒股同學會 | 菲一般講股

https://t.me/UTOFINANCE

個股全方位,專家教路。

入貨價,止蝕位,追擊升幅大拆解。

陳卓瑩新歌「不遺餘力」呼籲社會關注抑鬱症

陳卓瑩新歌「不遺餘力」呼籲社會關注抑鬱症

剪接影片:https://www.instagram.com/p/CH-uaKIBUxy/?igshid=tpgwp5v03mdp